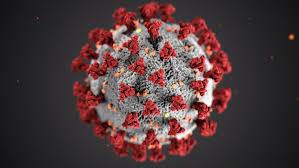

The coronavirus has proved to be a disrupter of not only the global healthcare system but also the worldwide economic system. Uncertainty about the short and long terms effects of the pandemic permeates discussions across communities from Asia to South Africa. The interdependence of health systems and the financial systems have never been more apparent than during this time. The realities of the pandemic are especially crushing to the small business communities. Entrepreneurs realize the consequences of inadequate risk management, lack of contingency plans and and the absence strong fiscal controls for business survival.

In the United States, government funded stop gap programs such as the Emergency Injury Disaster Loan (EIDL) and the Payroll Protection Program (PPP) continue to rollout but many micro and small business owners have not obtained needed funds. Reasons for denials range from firms not having established valued banking relationships to missing adequate documented payroll and financial documents.

As businesses scramble for survival, they now face the real impetus to do the necessary work to course correct their business operations and address the apparent shortfalls in their fianncial management system.